RedPepper Mergers works with clients who are growing innovative sustainability business to

- BUILD commercial structure and strategy (ask us about how you become Investor Ready), and

- then GROW our clients’ local and international revenue and profitability (ask us about SalesMagic and Carpe Diem)

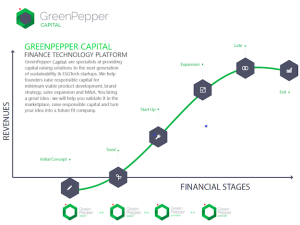

For this they need to RAISE enabling green finance. We source this aligned capital, through GreenPepper Capital‘s targeted investee / investor matching platform which provides 3 options

(i) angel project funding (kickstart money),

(ii) debt funding and equity finance (post product creation), and

(iii) equity venture capital (post revenue)

to commercial business models with an ESG-led theory of change.

Start-ups get the right money at the right time. (Ask us about how your Capital Raise)

Our point of difference is that we only work with a handful of carefully vetted, viable clients at any one time to actively manage them. Our endgame is to ensure that start-ups realise their impact goals and their stakeholders’ “TBL return on investment” expectations. So you can be certain of our hands-on, conscientious focus.

The combination of GreenPepper Capital, and our partnership with accredited ESG consulting specialists (SIMpli), means we support green projects (subject to proven environmental sustainability evidence and risk assessment).